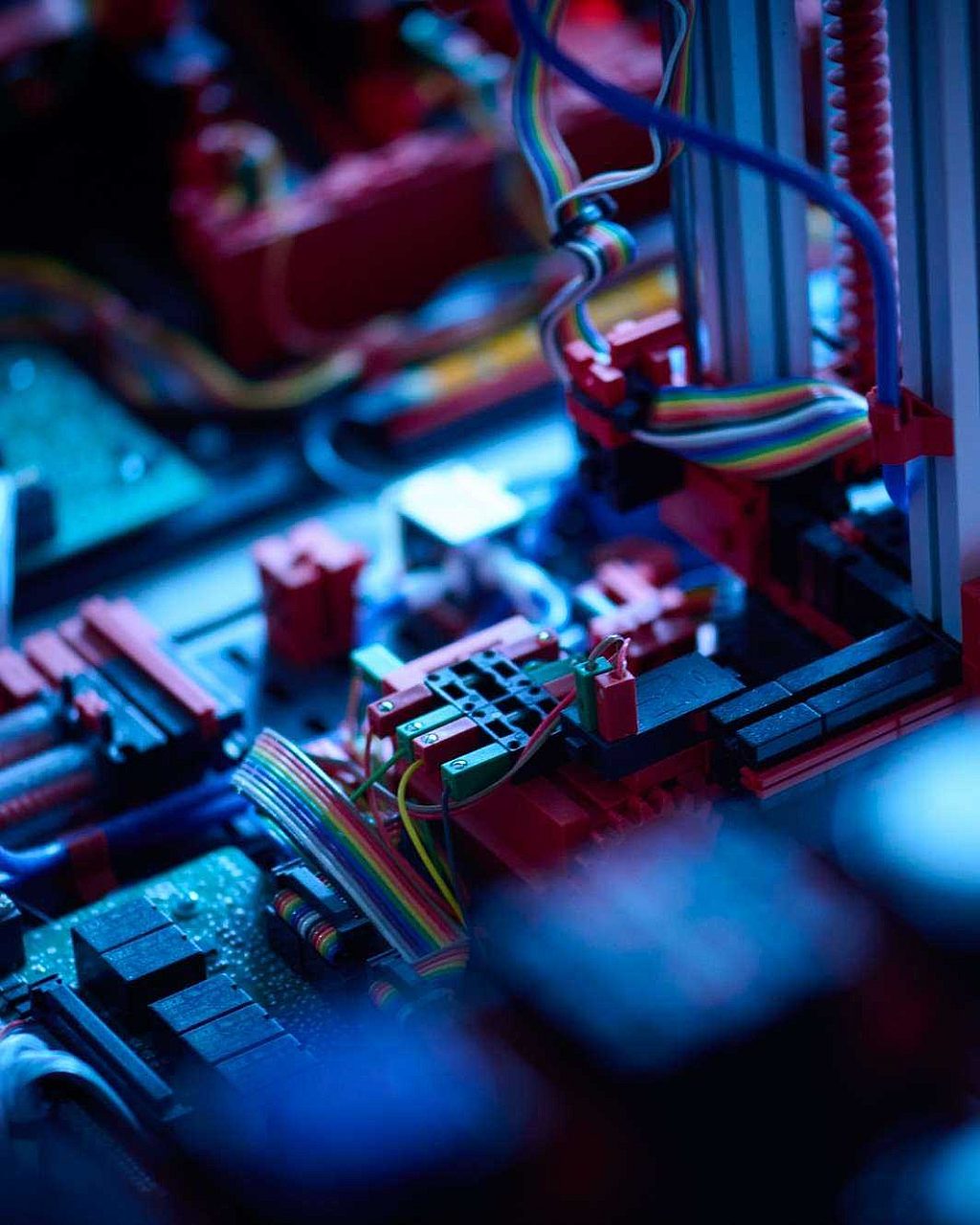

IT als basis voor zakelijk succes

Missie kritische IT heeft altijd centraal gestaan in ons werk. Met 100% uptime, een projectsuccespercentage van meer dan 99% (35% branchegemiddelde) en een nummer 1 positie in klanttevredenheid, hebben we geleerd dat echte vooruitgang niet alleen draait om feilloze technologie. Het draait om weerbaarheid, vertrouwen en duurzame waarde. Wanneer we ons toewijden aan een klant, dan verzekeren we ons ertoe de bedrijfsvoering draaiende te houden, audits feilloos te halen en mensen vertrouwen te geven. Door te plannen, te bouwen en uit te voeren door hetzelfde team, maken we daadwerkelijk bedrijfsvoortgang mogelijk die duurzaam is.

Onze klanten

Voor elk project ontwikkelen we de beste IT-oplossing en werken we met de allerbeste partners.

Wij zijn trotse partner van:

Ons value proposition framework

Ontgrendel het volledige potentieel van de cloud met onze betrouwbare oplossingen. Wij helpen je de kracht van cloudtechnologie te benutten om innovatie aan te jagen, de veiligheid te verbeteren en operationele efficiëntie te verhogen, zodat je business concurrerend en resilient blijft in een voortdurend veranderend landschap.

Maximaliseer de waarde van jouw data en AI met onze deskundige oplossingen. Wij transformeren ruwe data in actionable insights, wat leidt tot weloverwogen besluitvorming, operationele efficiëntie en strategisch succes voor jouw organisatie.

Benut de voordelen van geavanceerde software met onze innovatieve oplossingen. Wij ontwikkelen, moderniseren en integreren mission-critical applicaties om de wendbaarheid, security en efficiëntie te verbeteren, zodat je bedrijf floreert in een concurrerende omgeving.

Versterk de beveiliging van jouw business met onze uitgebreide oplossingen. We integreren robuuste security-maatregelen in je IT-infrastructuur en daarbij waarborgen we de resiliency, net als de compliance en bescherming tegen steeds veranderende bedreigingen.

Onze aanpak: experts in the lead

Wij geloven dat, met de juiste combinatie van onze én jullie experts, alles mogelijk is. De IT oplossingen die wij ontwikkelen geven het beste resultaat als we samen zorgen dat jullie de volledige controle hebben over jullie eigen technologie.

Hoe wij werken \Kom je bij ons werken?

Wij gaan altijd voor de volle 100%. Geen wonder dat we ook de zoektocht naar nieuw talent heel serieus nemen. Werk je bij ons, dan ben je master of your own destiny.

Momenteel hebben we 34 vacatures in Technology , Business , Support

Certifications & assurance

Wij beschikken over certificeringen die hoogwaardige service garanderen, jaarlijks onafhankelijk gecontroleerd via externe audits. Deze certificeringen waarborgen de hoge standaarden die je van ons kan verwachten.

It’s the people, actually

Onze organisatie is ingericht op de ambities die we samen delen. We hebben geen van allen een baas, maar zijn allemaal verantwoordelijk voor ons succes. We werken in zelfsturende teams met experts in the lead, en zo kunnen we allemaal 'deliver our own promise'. Bij ons is hetzelfde team verantwoordelijk voor de uitvoering als voor het advies en de oplossing. Dat zouden we niet anders willen. En onze klanten ook niet.

Wie we zijn \